Regular Package

VIP Package

Limited Liability Corporations (or LLCs) are very important when it comes to protecting your business in your beginning stages. They help you save money tax-wise and have fewer restrictions than you may think.

This pandemic has brought on so much unrest, and you would think that it would have a similar effect on businesses, but it actually has led to more people considering for the first time forming their own businesses. How do I know this? I have put out free content on LLC ownership, trademarks, copyrights, and contracts on my personal social media pages, and I have noticed one major theme: people really want to know 1) how to protect their businesses or 2) how to start up a business during this time while we are all stuck in the house and quarantined. No matter what type of business you choose to form, it is important to take precautions to start up a business that works for your needs.

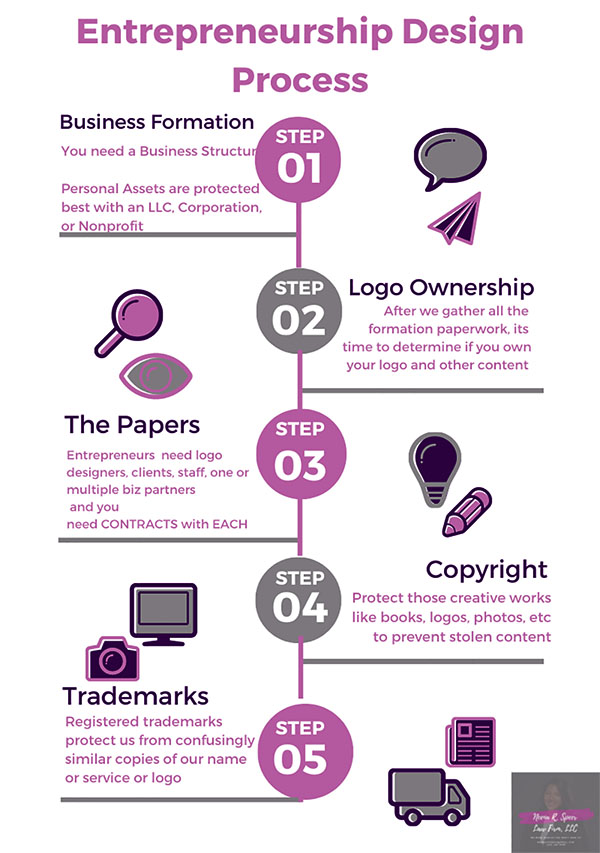

I like a 5-Step Process when I explain concepts to people, so here are my fast five reasons why you need an LLC.

1. You Can Protect Yourself

When you start a business, you probably never knew that your personal assets were on the line before. Most business owners start a sole proprietorship that has the least structure which is good in theory but bad news when you run into a problem. I know we all expect to never have any issues with customers, right? Wrong. We all will eventually face an obstacle in the road, and we do not want to be sued. If you are sued, without an LLC or Corporation, you face some pretty steep liabilities. They can attach the damages to any personal asset you own. Yes, that includes your house, your car, your 401 K, and your personal bank accounts. That sounds kinda scary, right? Yes. The good news is that you will be a strategic and clever business owner, so you will already have that LLC formed. That way your assets are safe, and you can focus on growing and protecting your business. Yes, you may want an LLC, but just know that an LLC can easily become a Corporation later on, but that’s another blog.

2. You Can Have Less Structure

Have you wondered why people LOVE LLCs? It is because, unlike corporations, you do not have to observe the normal formalities. Once you have formed your LLC, if you develop an operating agreement (which is a rule book for the way you want the company to run and who owns it) you will not be subject to default rules in your state for compliance. Also, you do not have to run meetings or keep meeting minutes like you would a corporation. (P.S. corporations are what you would create if you wanted to form a non-profit organization. Therefore, my charitable business-minded folks, keep that in mind when you are considering what to form.) Your LLC can also have a charitable proceeds component where you donate a portion of the profits to your charity of choice later on. With non-profits, there are all sorts of restrictions on your money and the kind of money and influence you can take on. There are also restrictions on regular meetings, minutes, and the number of people you need to form one. In Alabama, you need 3 people to form a non-profit, but not for an LLC. You can form an LLC with just you and not have to hold meetings nor create minutes. Isn’t that easy?

3. You Can Run It How You Want

Another benefit of the LLC is that if you want to add more leaders later on you can just do so. Of course, you might want to update your operating agreement and re-file to reflect that change, but you do not have to seek majority board approval to make decisions. Alternatively, with a corporation, every decision you make that will adversely or positively affect the company or its shareholders must be voted on by the group. This a great thing when everybody sees eye to eye, but when you start selling shares, major shareholders gain the right to weigh in and tie your hands from future decisions if they choose to. That is not how an LLC functions, and that should bring you some major relief!

4. You Can See Tax Benefits

Did you know that you are double taxed without an LLC? Corporations, everybody’s favorite thing because of the stocks you can sell, are taxed twice. Once on the dividends and once on the income, and people just have no idea. The value of an LLC is that, unlike a sole proprietorship where the business is not taxed separately from the owner, an LLC is not taxed at the entity level which means that the income and losses pass through to the members’ (owners’) individual tax returns. However, always consult a tax attorney to be certain of all your tax concerns.

5. You Can Modify How You Are Taxed to an S-Corp Later

A lot of people toss around business terms and always mention the term to form an S-Corporation. Just so you know, there is no such thing as an s-corporation as a business entity. However, you can elect to have your LLC and even your Corporation taxed as an S-Corporation. That will come in handy when you are making the big money later on and you can get taxed a bit less if you can designate “a reasonable salary” deduction that you pay yourself consistently. However, a CPA knows best, so make sure before you elect for S-Corp, you reach out to a tax professional.

As always there are tons of online sites to file your LLC, but if you are uncertain or need your questions answered on where to start, instead of using an online application seek out the advice of a legal professional before deciding how to form your LLC or other business structures.

There was a free live event on “Best Kept Secrets in LLC Formation” with Neena on common mistakes when you form an LLC and leave with a plan of attack even during a crisis and she wants to give you her FREE CHECKLIST! Do you want your FREE COPY, then sign up here now?

The above is not legal advice. Should you need advice on forming a business entity, trademarks and copyrights, criminal defense matters, family law disputes, and estate planning concerns, call an attorney at Neena R. Speer Law Firm LLC.

Neena R. Speer Law Firm LLC. is a Birmingham, AL boutique firm focused on the individual and their needs from areas ranging from LLC/Business Formation to Copyrights, Trademarks, Contract Drafting/Review to Criminal Defense, Estate Planning and Family Law.

Call today at 205-490-8068 or email.

Podcast #2